While it is always easier to restore your existing policy, it may benefit you to call different insurance policy service providers after a certificate suspension. This will assist you determine which insurer will offer you the finest prices (auto insurance). Prepare to hit the road once again with a cars and truck insurance coverage from Vern Fonk. insurance coverage.

What Is SR22 Insurance policy? SR22 isn't really a kind of insurance policy it's a kind that your insurance policy carrier have to fill up out and also data as proof to the government that you're properly insured, so your driver's license can be restored.

You may likewise see it created as SR-22 insurance coverage or an SR-22 type. Of training course, your insurance company should be willing and also able to submit this documentation with the state to alert them that you have insurance coverage, but not every insurance coverage service provider uses SR22 declaring with their insurance policy policies.

This is since the state wishes to know that you stay in good standing with your insurance business which you are keeping the state-mandated amount of insurance whatsoever times. insurance. With this declaring, your insurance policy company is informing the state that you are financially accountable as well as keeping protection for any type of crashes.

Rumored Buzz on Insurance - Nevada Department Of Motor Vehicles

Who Needs SR22 Insurance? Exactly how do you recognize if you or somebody you understand needs SR22 insurance?

SR22 insurance policy for negligent driving: The state will certainly call for SR22 declaring if you have a serious moving infraction sentence on your record, such as negligent or reckless driving (division of motor vehicles). SR22 for suspended license: If your certificate is suspended, such as for driving without insurance or for receiving multiple website traffic tickets quickly, then the state will need SR22 declaring.

If you fail to carry the proper amount of insurance protection in Missouri, your permit might be suspended, as well as you'll be required to submit an SR22 (dui). If you wish to return to driving as well as the state requires that you file an SR22 kind, this is a step that can not be skipped.

Are SR22 Insurance Coverage as well as SR22 Certifications the Same? Is SR22 insurance policy the same as an SR22 certification? Component of the confusion surrounding SR22 insurance is the numerous terms that insurance coverage firms as well as states use to explain the very same thing. coverage. SR22 insurance coincides as an SR22 certificate. These terms are additionally made use of synonymously with SR22 type and SR22 record.

Some Ideas on Get Sr22 Insurance In Washington State Financial ... You Should Know

What concerning the FR44? It's vital for chauffeurs to keep in mind that, though very similar, the FR44 as well as the SR22 are not the very same. insurance. Where the FR44 varies is in its responsibility limit needs, which are typically dual the state minimum. If the minimum obligation restriction in a state is $25,000 per person, the demand with an FR44 would certainly be $50,000 per person.

insurance group no-fault insurance dui sr-22 sr22

insurance group no-fault insurance dui sr-22 sr22

The only method you can obtain an SR22 type is by acquiring an auto insurance coverage policy with an insurance provider. An SR22 can not be acquired in any other way. Buying a car insurance coverage policy that consists of filing an SR22 certificate isn't made complex or at the very least, it shouldn't be with the appropriate insurance service provider.

Merely contact your insurance representative to make this demand, and also ask that they file an SR22 on your part. auto insurance. Given that several insurance policy companies don't submit SR22 and do not wish to guarantee a chauffeur who has a significant driving offense on their record, you may desire or need to contrast automobile insurance estimates from various suppliers.

SR22 Insurance Policy for a New Policy Depending on how you're buying your plan, you can make the selection for this plan online or tell your insurance agent what you're looking for. Your insurance coverage service provider ought to after that deal with the rest of the process. When purchasing insurance that consists of SR22 filing, you might wish to deal directly with your agent, as the process might move a little faster as well as you must have the ability to obtain an extra precise price.

A Biased View of Sr22 Insurance And How It Works - Dairyland® Auto

deductibles underinsured insurance companies sr22 coverage vehicle insurance

deductibles underinsured insurance companies sr22 coverage vehicle insurance

In reality, you might not recognize what the fee is until you have actually currently acquired the policy. To make sure you're getting the very best insurance policy solution, you might intend to meet an insurance agent that has experience dealing with high-risk chauffeurs and can get you the insurance coverage options you look for.

You'll be called for to acquire the very same responsibility restrictions from your main policy on your SR22 plan. Some motorists may not desire to lose their main insurance carrier. This might be because they're obtaining excellent discount rates, or they have actually bundled insurance coverage with this provider. Purchasing a separate non-owner insurance policy to please the SR22 requirement might be the ideal alternative for them.

coverage driver's license liability insurance insurance coverage car insurance

coverage driver's license liability insurance insurance coverage car insurance

Depending on the state, you'll just need SR22 insurance policy for one to 5 years. The length of time You'll Need to Bring SR22 Insurance coverage The size of time you'll require SR22 insurance might also rely on the offense. 3 years is the usually called for length of time that you'll require to have SR22 insurance coverage as long as you don't have any major offenses throughout that timeframe (insurance group).

If you terminate your plan with the SR22 filing before the called for quantity of time is up, your insurance carrier will inform the state (insurance). Your permit may after that be suspended or revoked, and you may have to begin again on the amount of time you're required to have SR22 insurance policy.

Not known Facts About Kansas Sr-22 Insurance (Rates, Companies, + More)

One instance is the FR44. In states like Virginia and Florida, the FR44 is called for instead of the SR22. To get an FR44, you should lug insurance coverage that totals twice the minimum liability limitation of that state. When Check out the post right here you have an SR22 in one state and move to a various state, you'll likely still be needed to bring SR22 insurance coverage in the state where you devoted the offense.

The Expense of Locating an Insurance Policy Service Provider That Provides SR22 Insurance policy The majority of insurance policy providers have the capability to offer SR22 insurance policy, yet some prefer not to. Depending on the business, you might obtain averted or simply receive no response to your request. Chauffeurs that find themselves in this scenario must instead seek an insurance policy service provider that provides high-risk car insurance.

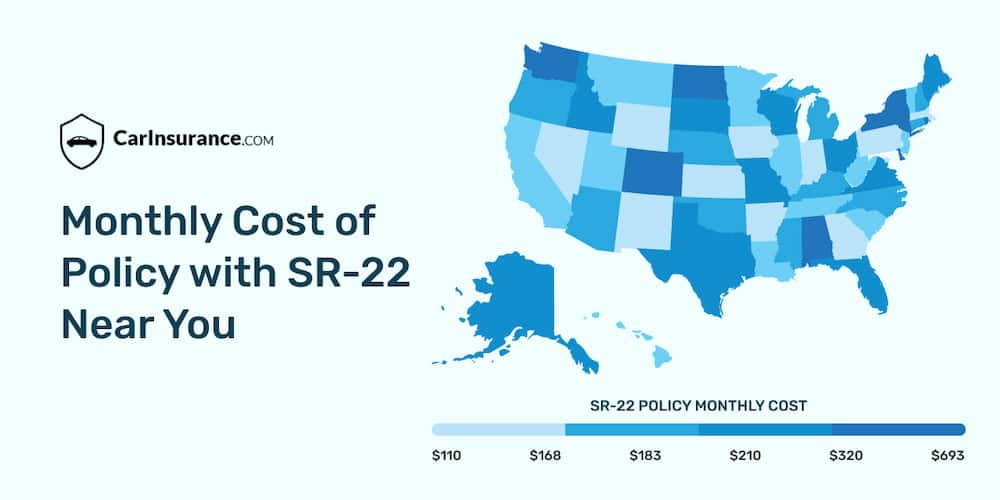

2. The Expense of Driving Violations When you discover an insurance coverage carrier that is ready to deal with you, what can you anticipate in terms of cost for SR22 insurance policy? With many insurance service providers, acquiring an auto insurance coverage with SR22 declaring can be expensive, though the high price is generally because of your driving violation instead of as a result of the state declaring fee.

High-risk motorists pay even more for insurance than chauffeurs that don't have any type of offenses on their records due to the fact that an insurer now sees you as an obligation. Major violations and also infractions that cause the need of an SR22 are dramatically trek up a motorist's insurance coverage price. A solitary DUI conviction can increase your rate drastically.

Getting The How Does Sr-22 Insurance Work To Work

In Missouri, the complying with are estimates for boosts you can anticipate on your ordinary annual price after particular offenses: A DUI conviction: If you're caught driving under the influence, this conviction could raise your typical yearly insurance coverage rate - ignition interlock. An at-fault crash: If you are determined to be to blame for an accident, this offense could lead to an increase in your typical yearly insurance policy rate.

As long as you remain insured and maintain your record tidy, you'll be paying basic vehicle insurance policy rates in a few brief years. The Fee for SR22 Insurance policy The price of the state declaring cost depends on the state (underinsured).

Any automobile with a current Florida registration should: be guaranteed with PIP as well as PDL insurance coverage at the time of vehicle registration. have a Vehicles signed up as taxis have to lug bodily injury liability (BIL) protection of $125,000 each, $250,000 per occurrence as well as $50,000 for (PDL) insurance coverage. have continual insurance coverage even if the car is not being driven or is inoperable.

You need to acquire the registration certification as well as certificate plate within 10 days after starting employment or registration. You should likewise have a Florida certification of title for your lorry unless an out-of-state lien holder/lessor holds the title and will not release it to Florida - sr-22 insurance. Vacating State Do not cancel your Florida insurance till you have actually registered your vehicle(s) in the various other state or have given up all valid plates/registrations to a Florida. sr22 insurance.

Indicators on Sr-22 Car Insurance Basics You Should Know

sr-22 liability insurance sr-22 sr22 coverage insure

sr-22 liability insurance sr-22 sr22 coverage insure

Penalties You should preserve required insurance coverage throughout the enrollment duration or your driving advantage and certificate plate might be put on hold for approximately three years. There are no stipulations for a short-lived or challenge driver permit for insurance-related suspensions. Failure to maintain needed insurance policy coverage in Florida may cause the suspension of your driver license/registration as well as a need to pay a reinstatement charge of as much as $500.

occurs when an at-fault event is sued in a civil court for problems triggered in an automobile accident as well as has not completely satisfied residential or commercial property damage and/or physical injury requirements. (PIP) covers you despite whether you are at-fault in a collision, up to the limits of your policy. insurance group. (PDL) spends for the damages to other individuals's residential or commercial property.

Does Nevada enable Evidence of Insurance to be offered on a mobile phone? Yes. Evidence of Insurance coverage might be offered on a published card or in an electronic format to be shown on a mobile electronic device. Insurance providers are not needed to supply electronic proof. They need to always provide a printed card upon demand.

Insurance Policy Confirmation Notices are never random. Notices mean we do not have a valid record of your obligation insurance policy coverage or that there is a possible gap in the protection.

A Biased View of How Long Do I Carry Sr22 Insurance In Tennessee?

Usually, this takes place when you alter insurance coverage companies. How do I react to the letter? There is no requirement to visit a DMV workplace.

If you have kept constant insurance coverage, you will have the ability to enter your plan info. The site will let you know if the info you entered verified with your insurer. If it does validate immediately, you will certainly receive an adhere to up letter letting you know the case has actually been solved (coverage).

We will certainly mail your reaction to your insurance provider to let them know we require your insurance coverage documents for the lorry. The 2nd alternative is to complete the notice as well as mail it straight to our workplace. dui. It is a company reply so there is no requirement for shipping. I lost the DMV letter, what can I do? There are a number of options to validate your insurance policy.

I entered my insurance info online yet it says "pending"? This implies the insurance policy details you went into did not confirm with your insurance company's database quickly.<</p>